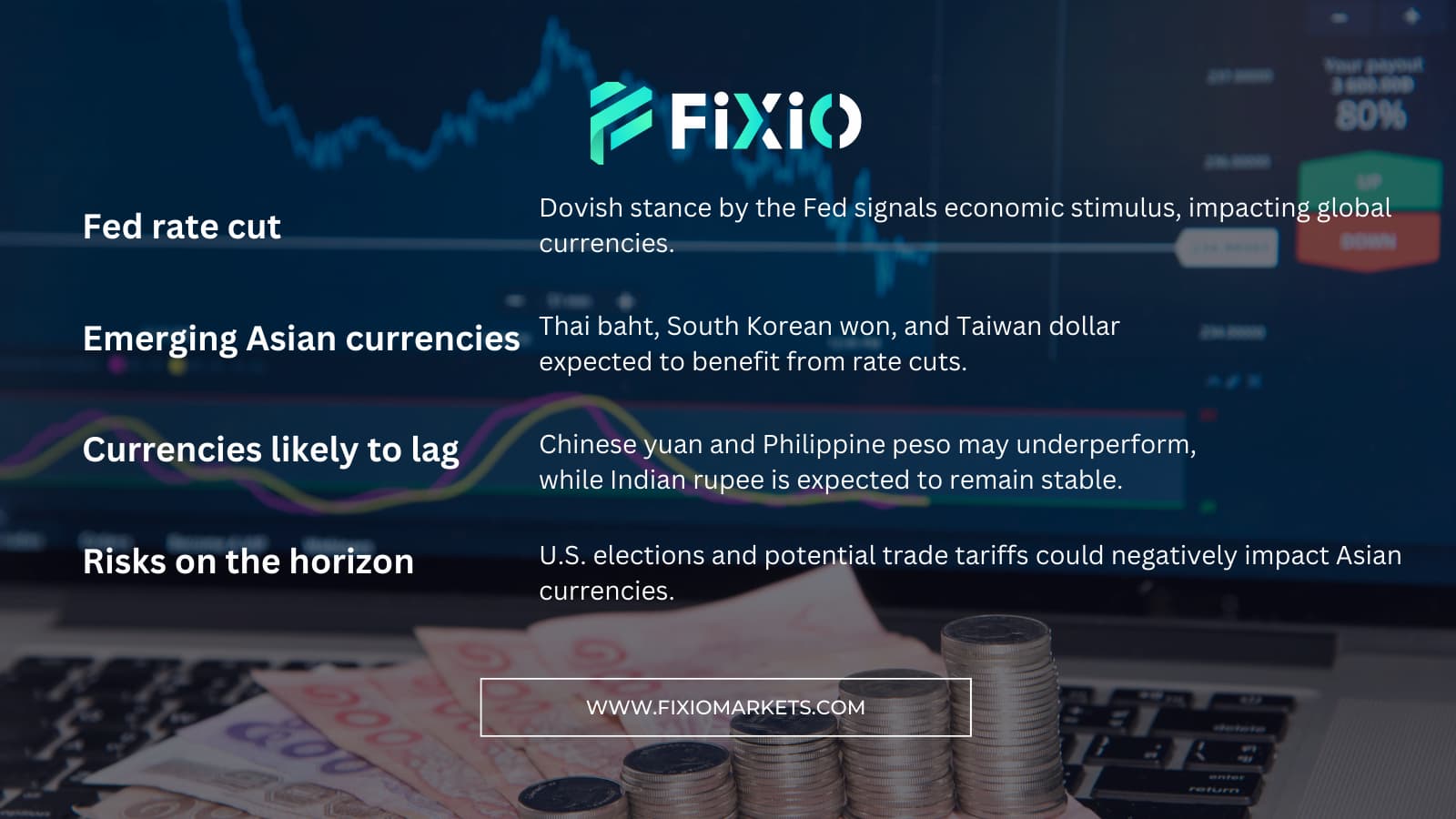

The recent decision by the Federal Reserve to cut interest rates for the first time in over four years has sparked discussions across global markets. A dovish stance by the Fed typically signals a focus on stimulating the economy, which can lead to changes in currency performance, especially in Asia. In the case of emerging Asian currencies, the outlook is generally positive. The currencies like the Thai baht and South Korean won expected to benefit. As always, it’s essential for Forex traders to stay informed on the latest news and trends to make informed decisions.

Goldman Sachs (GS) has highlighted that the Fed’s move to lower rates could trigger a cycle of rate cuts by Asian central banks. This accelerated easing cycle is likely to benefit emerging markets. According to GS, the Thai baht, South Korean won, and Taiwan dollar are expected to perform well. These rate-sensitive currencies have strong potential to appreciate. There are because of improved risk sentiment and favorable economic conditions in their respective countries.

Not all Asian currencies are positioned for growth. The Chinese yuan continues to struggle due to persistent economic weaknesses in China. Likewise, the Philippine peso is likely to underperform. The Indian rupee is expected to remain stable. It's supported by the Reserve Bank of India’s focus on maintaining currency stability. While some currencies may face challenges, understanding these trends can help traders make well-informed decisions.

Despite a generally favorable outlook for many Asian currencies, there are potential risks on the horizon. Goldman Sachs notes that the upcoming 2024 U.S. elections pose a significant risk, particularly regarding the possibility of increased trade tariffs targeting China. Such developments could negatively impact currencies like the South Korean won, Malaysian ringgit, and Thai baht, which are particularly vulnerable to trade-related headwinds.

For more detailed Forex trading news and in-depth analysis, check out our website: Explore the latest insights here.

Discover how a dovish Fed stance influences Asia’s emerging market currencies and the risks ahead for Forex traders.

Superior trade execution & trading conditions with the NDD method.

The online FX industry provides a platform for investors worldwide to engage in the buying and selling.

Subscribe to our daily newsletter and get the best forex trading information and markets status updates

Trade within minutes!

Comment (0)