Trading Conditions

- FIXIO

- Trading Accounts

-

Trading Platforms

- Instruments

- Managing Your Funds

- Trading Accounts

- GLOBAL FINANCIAL MARKETS

- Start trading with FIXIO Markets

- Open a Demo account

Trading Condition

Please read the following terms and conditions carefully before using FIXIO services.

You may only open and use a FIXIO trading account if you agree to these terms and conditions. By opening a FIXIO trading account, you agree to be bound by the terms and conditions of this agreement. If you do not agree to this Agreement, please do not open a FIXIO trading account.-

Market Watch

Prex Marekts Limited obtains the best prices from several major banks/liquidity providers/exchanges to ensure accurate market information and pricing. In the event that some price providers are closed or experiencing malfunctions, the quotes provided for all or some of the CFDs will reflect the prices believed to be the current bid and ask prices for each CFD. Our prices do not guarantee to be the best prices available in the global market.

By using our market watch, clients agree that it serves as an indicator of the current global market. If there are any misunderstandings regarding this service, please contact Our customer support.

Furthermore, the charts for all traded instruments are displayed based on default spreads, but the prices shown in the market watch may differ depending on the type of trading account. This difference is due to variations in markup.

-

Spread

Prex Markets Limited provides clients with competitive spreads on all trading instruments, although there may be occasional slight increases on some or all trading instruments. This ensures that we deliver the best market conditions and tightest spreads.

One of our primary objectives is to ensure that client orders are executed at the best market price and with the tightest spreads available.

During order execution, our markup is applied to the best market prices based on the client's trading account type. Transparent markups are published in the table below, indicating the markup value in PIPs for each account type and currency pair.

Upon order execution, our markup is applied to the best market prices according to the client's account type. Consequently, the impact of the markup on spreads is illustrated in the table below, representing the lowest possible spreads in PIPs for each account type and currency pair, taking into consideration that our spreads are variable. The table showcases the best spreads available (as low as) for each FX account type and currency pair.

Account Type ECN STP PREMIER SPREADS 0.0pips~ 1.2pips~ 0.7pips~ -

Hedging

FIXIO allows clients to open positions in the opposite direction of previously opened positions in their trading accounts, reduce losses, and decide later when to enter the market.

Hedging of commodities with corresponding futures OTC contracts is prohibited (for swap-free accounts). One direction of this type of hedging must be closed immediately, as this represents an attempt to take advantage of the swap-free feature and profit from the swap. If the client fails to take steps to avoid such practices, FIXIO must unavoidably close these accounts without notice or take other action (by retroactively deducting swaps or by other means).

The margin requirement is calculated for each instrument according to the net position opened at a given moment, so hedged positions are held in the trading account without affecting the value of the margin requirement.

-

Order Types

Order Types

The following orders can be placed by the client:

- OPEN: An order to open a new position.

- CLOSE: An order to close an existing position.

- PARTIAL CLOSE: An order to close a portion of an open position at the current market price and leave the remaining lots (part) floating.

- Modify: An order to add, remove, or edit orders such as Stop Loss, Take Profit, Buy Limit, Buy Stop, Sell Limit, Sell Stop.

- CLOSE BY: In the case of hedging being allowed, an order to close hedged positions on a specific instrument.

- Market orders: Orders sent from the client terminal, either by the client themselves or through a plug-in hooked to the client terminal (Expert Advisor), to buy or sell an instrument at the current market price displayed on the market watch.

- Pending orders: This type of order can be set in the same way as market orders but at prices predicted by the trader and may be executed in the future, such as limit, stop, and entry orders.

- All pending orders are guaranteed based on the fair market value.

- All pending orders are valid until cancelled (GTC), unless the client sets an expiry time and date on entry orders or if the financial instrument expires.

- All pending orders must be placed in accordance with the rules specified in the contract specifications for each instrument.

- Once pending orders are in process, the system will reject any attempted cancellations or modifications during that time.

- Pending order conditions may vary during volatile market conditions.

- In situations such as market openings after weekends or holidays, the release of important economic and political news, or in the case of force majeure events, orders (sell stop, buy stop, stop loss) are executed at the first available prices in the market.

- Although such situations are not frequent, caution should be exercised when leaving pending orders for weekends and holidays.

- Placing stop orders prior to the release of financial news is not permitted, and such orders may be rejected, deleted, or filled at the best available market prices at that time.

-

Rollover Swap

【Rollover】

FIXIO provides competitive swap rates. Swap rates are clearly displayed and easily accessible for customers to check. Rollover strategies are implemented for a period of 3 days and are calculated based on prevailing interest rates.

【Overnight Positions】

Overnight positions incur swap interest due to rollover. For FX instruments, both the long/short positions held and the interest rate differential between the traded currency pairs affect the swap applied. The same applies to stocks and stock indices, where the swap applied varies depending on whether the position is short or long. However, there are no overnight costs for futures contracts with specific expiration date.

【Rollover Explanation】

Rollover is the process of extending the settlement date (the date when a trade should be settled) of an open position. In the foreign exchange market, all spot trades are settled two business days later. However, since spot delivery does not occur in margin trading, open positions are settled at the end of each day (GMT 22:00) and resumed on the next trading day. This results in a one-day extension of the settlement, which is referred to as "rollover." Rollover is executed based on swap agreements, resulting in a credit or debit (profit or loss) for traders. At FIXIO, rollover is applied without closing open positions, and swap interest is credited to customers' trading accounts for positions held overnight based on prevailing interest rates.

【Rollover Policy】

For all positions opened after GMT 22:00, FiXi applies swap interest at competitive rates. Rollovers are not performed on Saturdays and Sundays, but banks do charge interest on held positions over the weekend. To compensate for this, FIXIO applies a 3-day rollover for each applicable instrument, as indicated in the table below:Instrument

Applicable Day

FX and Spot Precious Metals

(Gold and Silver)Wednesday

Spot Stock Indices and Spot Energy Products

Friday

【Rollover Calculation Method】

1. FX and Spot Precious Metals (Gold and Silver):

Rollover interest is calculated based on the interest rate for the following two business days. The specific interest rate is determined based on the interest rate differential for each currency pair. The general calculation formula is as follows:

Trade Lot Size * (+/- Interest Rate for the Following Two Business Days - FIXIO Commission)

For stocks and stock indices, the rollover rate is determined based on the underlying interbank rate plus or minus FIXIO's commission.

2. Stocks and Stock Indices:

Rollover rates are applied to positions in stocks and stock indices. These rates are determined based on the underlying interbank rate for the respective stocks or indices. Additionally, FIXIO's commission is added or subtracted for both long and short positions. The general calculation formula is as follows:

Trade Lot Size * Settlement Price * (+/- Short-term Interbank Rate - FiXi Commission)

The +/- sign is determined by whether the position is a short or long position for the respective instrument.

【Rollover Reservation】

GMT 22:00 is considered the start and end time of a trading day. If there are open positions exactly at GMT 22:00, they are subject to rollover and held until the next day. Positions opened at 22:01 are not subject to rollover for the next day, but positions opened at 21:59 will have rollover applied at GMT 22:00. Any credits or debits related to open positions will be reflected in customers' accounts within one hour from GMT 22:00. -

Leverage*

"Leverage" refers to the ratio of transaction size to initial margin. A ratio of 1:100 means that the initial margin required to open a position is 1% of the original contract value.

The standard lot size of 1 unit is the specified measurement unit for each FX/CFD contract. The choice of leverage rate ranges from 1:1 to 1:400 depending on the type of FX/CFD, the amount of active trading volume in the account, and at the discretion of the company. By default, the leverage rate is set at 1:400 when opening a client's trading account. Clients can change the leverage of their trading account through "My Page => Change Leverage." The company reserves the right to reject requests for leverage changes in client accounts. Additionally, the company may change the leverage in client accounts without prior notice.

-

Margin Requirements

Margin Requirements

Prex Markets Limited is responsible for providing and maintaining the initial margin within the limits determined, set, or updated at its sole discretion.

It is the client's responsibility to understand how margin is calculated.

Orbex has the right to amend any entry in the Contract Specifications section for each FX/CFD, including margin requirements. These changes may affect new and existing/open positions/trades and can be communicated through internal mail messages or on the company's corporate website, except in the event of a Force Majeure Event.

In the event of a Force Majeure Event, Orbex has the right to change margin requirements without prior written notice to the client. In this situation, the company has the right to apply new margin requirements to new positions and to positions that are already open.

If the Equity to Margin ratio falls below 5% at any time, Orbex has the right to close some or all of the client's open positions without the client's consent or any prior written notice. To determine if the client has breached this clause, any sums not denominated in the currency of the client's account will be treated as if they were denominated in the currency of the client's account by converting them at the relevant exchange rate for spot dealings in the foreign exchange market.

The client is responsible for promptly notifying the company if they believe they will be unable to meet a margin payment when due.

The company is not obligated to make margin calls for the client.

When the company executes or arranges a transaction involving an instrument, the client should note that, depending on the nature of the transaction, they may be liable to make further payments if the transaction fails to be completed or upon the earlier settlement or closing out of their position. The client may be required to make further variable payments as margin against the purchase price of the instrument, instead of paying (or receiving) the whole purchase (or sale) price immediately. The amount of margin payment required may be affected by changes in the market price of the client's investment. The client agrees to pay the company on demand such sums as margin as are required from time to time under the rules of any relevant market (if applicable) or as reasonably required by the company to protect itself against loss or risk of loss on present, future, or contemplated transactions under this agreement.

-

Slippage

Slippage refers to the execution of a trade at a price different from the order price or the price set by the client. This can occur during highly volatile market conditions, such as economic or political news. The order will be executed at the best available market price.

Prex Markets Limited does not apply slippage under normal market conditions but may apply it to stop pending entry or liquidation orders during periods such as our non-business days, weekends, bank holidays, or other international economic events or market turmoil. In such cases, stop orders will be executed at the open price deemed suitable by Prex Markets Limited.

Clients acknowledge that slippage may occur in accordance with the liquidity providers' terms and conditions and understand that this is beyond the control of Prex Markets Limited. Clients agree to waive Prex Markets Limited from any liability that may arise from, but not limited to, damages, expenses, or losses incurred in relation to or directly or indirectly resulting from such terms and conditions.

-

Scalping

Scalping is a trading strategy in which traders (scalpers/Pip hunters) aim to take advantage of small price movements and narrow ranges by executing numerous trades within short time frames.

At Prex Markets Limited, scalping is permitted without restrictions in the variable spread account type.

-

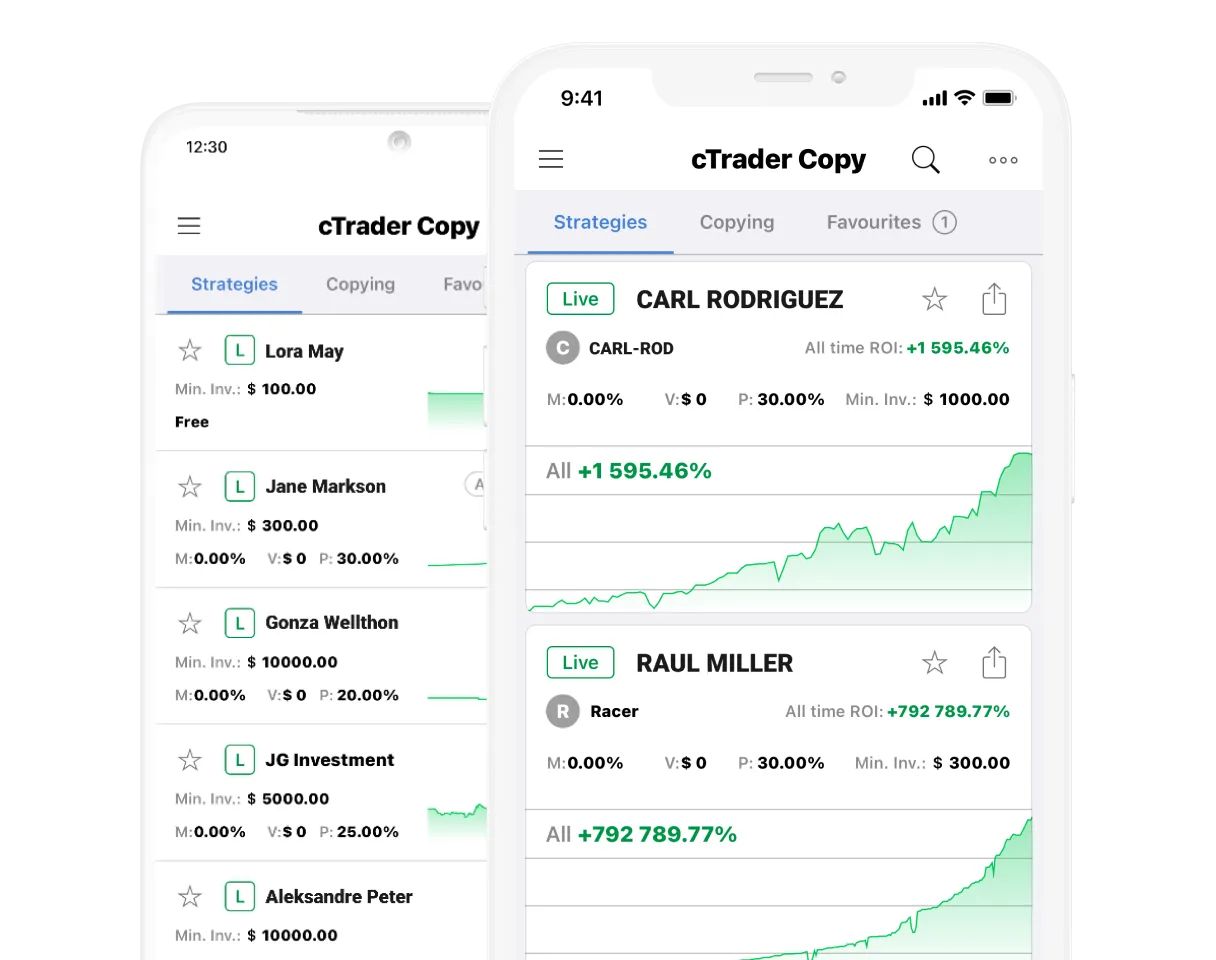

cBot and Copy Trading software

The "cBot" and "Copy Trading" features in cTRADER are enabled by default. When using these features, the following conditions apply:

If customers use trading software such as "cBot" and "Copy Trading," these features rely directly on the customer's trading terminal. As a result, trades are executed solely under the customer's responsibility, and we assume no liability. In the event that the use of additional features/plugins by the customer affects the reliability, smooth operation, or order of our trading platform, as determined by us, we reserve the right to terminate the agreement with the customer and cancel/delete those trades.

We shall not be held responsible for any losses or expenses incurred by the customer directly or indirectly, whether related to the actions, inaction, or negligence of third parties or third-party software, including but not limited to automated trading, copy trading, virtual private networks, and any other trading tools.

-

Stop Out

The stop out level for all trading accounts is set at "20%".

Additionally, all pending orders on the stopped out trading account will be deleted, and any potential losses resulting from the liquidation will be handled and covered by our company.

-

Reporting trading errors

When reporting a trading error, please send an email to [email protected] or contact us through the online chat.

For inquiries regarding a trading error, please provide the following information:

- Your name

- Your account number

- Details of the inquiry

- Your ticket number (if applicable)

- Your direct contact information

Please note that you must notify FiXi of any trading errors within 24 hours from the time of the error. Failure to do so will result in FiXi not conducting an investigation into the error.

Any trading errors for which our company is responsible will be rectified.

-

System Failure

In the event that an order is not executed as instructed due to a system malfunction, or in case of urgent inability to connect due to regular system maintenance, server updates, power or network outages, or any other reasons, please contact us via email at [email protected] or through the online chat.

-

Investor Alert

Foreign exchange margin trading carries high risks and may not be suitable for all investors. Before engaging in foreign exchange margin trading, you should carefully consider your investment objectives, experience, and risk tolerance. You should not invest funds that you cannot afford to lose, as there is a possibility of losing part or all of your investment capital. You should be aware of all risks associated with foreign exchange trading and, if in doubt, seek advice from an independent financial advisor.

Risk of Investing in CFDs

CFDs involve significant risks, especially when high leverage is involved (the higher the leverage in CFDs, the higher the risk). Additionally, CFDs are not standardized products, and their conditions and costs vary among CFD providers. Therefore, CFDs are generally not suitable for most individual investors.Liquidity Risk

Liquidity risk affects your trading ability. It refers to the risk that your CFD or asset cannot be traded (to prevent losses or make profits) at the desired time.Execution Risk

Execution risk is associated with the possibility that a trade may not be executed immediately. For example, there may be a delay between placing an order and its execution.Internet Trading Risk

The use of an online trading system for executing trades over the internet involves risks, including but not limited to hardware and software failures and internet connectivity issues. FiXi does not control signal power, reception or routing via the internet, or the reliability of your equipment configuration or connection, and therefore cannot be held responsible for communication failures, distortions, or delays when trading via the internet.Consent

By reading, understanding, and accepting the following, you acknowledge and declare without reservation that:

- The value of financial instruments (including currency pairs, CFDs, and other derivative products) may decrease, and the amount you receive may be less than your initial investment or the value of the financial instrument may fluctuate significantly.

- Information regarding the past performance of financial instruments does not guarantee their current and/or future performance, and the use of past data does not constitute a reliable prediction of the corresponding future returns of the referenced financial instruments.

- Some financial instruments may not be immediately liquidated due to various reasons such as decreased demand, and we may not be able to sell them, and it may be difficult to obtain information about the value of such financial instruments or the extent of the risks associated or inherent in them.

- If financial instruments are traded in a currency different from your country of residence, fluctuations in exchange rates may have a negative impact on the value, price, and performance of the financial instruments.

- Financial instruments traded in foreign markets may carry risks that differ from the normal risks in your country's market. The potential for profit or loss from trading in foreign markets is influenced by fluctuations in exchange rates.

-

Inactive/Dormant Accounts

In the trading accounts held by clients at Prex Markets Limited, accounts with no trading activity for a certain period (more than 6 months) or accounts with zero balance/equity are classified as inactive accounts and considered dormant accounts.

Such dormant accounts may incur relevant charges/costs associated with the maintenance/administration of these accounts. When an account is classified as dormant, our company will charge a monthly "inactivity fee" of 20 USD, which will be billed and deducted from the balance of the respective account until the required funds become available or until the balance/equity reaches zero. However, this "inactivity fee" will not result in a negative balance on the account.

Dormant accounts that continue to remain inactive for a period of 12 months are classified as closed accounts and will undergo immediate closure procedures on the first day after the 12-month period of no transactions.

Closed accounts will be frozen immediately, and the account holder will not be able to engage in any further transactions using the closed account.

To reactivate a dormant or closed account, the account holder must go through the identity verification procedure, fund the trading account, and conduct at least one or more trades.

-

- Instruments

Get started now

Opening an account is as easy as 3 steps! Start investing in FX with FIXIO!

Sign up

Create an account in minutes & upload your documents.

Fund your account

Make instant deposits to your FIXIO Wallet via debit card, wire transfer or your preferred online payment method.

Trade

Download your favorite trading platform on your device of choice & begin trading.

Our websites use cookies to offer you a better browsing experience by enabling, optimising, and analysing site operations, as well as to provide personalised ad content and allow you to connect to social media. By choosing 'Accept all' you consent to the use of cookies and the related processing of personal data. Please view our privacy policy.

-

Necessary Cookies

Essential for website functionality, allowing navigation and login access.

-

Functional Cookies

Enhance user experience by remembering preferences and settings.

-

Analytics Cookies

Collect data on user interactions to improve site performance and content.

-

Performance Cookies

Monitor and optimize website performance for a smoother user experience.