FOREX

- FIXIO

- Instruments

-

Trading Platforms

- Instruments

- Managing Your Funds

- Trading Accounts

- GLOBAL FINANCIAL MARKETS

- Start trading with FIXIO Markets

- Open a Demo account

What is foreign exchange margin trading (FX)?

The foreign exchange market (Forex, FX, or exchange market) is the largest and most liquid financial market in the world, with over $5 trillion traded 24 hours a day, five days a week. The total value of foreign exchange transactions far exceeds the combined volume of the stock and futures markets by three times.

Forex Trading (FX)

Trade Your Choice of Major Forex

Symbol

Description

Currency Base

Margin Currency

Contract Size

Max. Leverage

Max Volume Per Trade

Min Volume Per Trade

Long Swap

Short Swap

Holding Period

3-Day Swap

Trading Hours

Action Why Trade Forex with FIXIO

70

Foreign Exchange Agreement Transactions

Access to 70 different Forex pairs

FIXIO provides our clients with access to the most liquid global forex market. Experience trading at a true institutional level through our superior forex liquidity and become an active forex trader in the global market.

0.0pips~

FIXIO's ECN Account

Trade forex with low spreads of 0.1 pips with a FIXIO ECN account

With a deep liquidity pool and abundant foreign currency liquidity, FIXIO can offer its clients the best forex spreads available. FIXIO fully understands the importance of keeping forex trading costs to a minimum, thus maximizing total forex trading profits.

9

How to Access Forex

9 Ways to Access Forex Trading

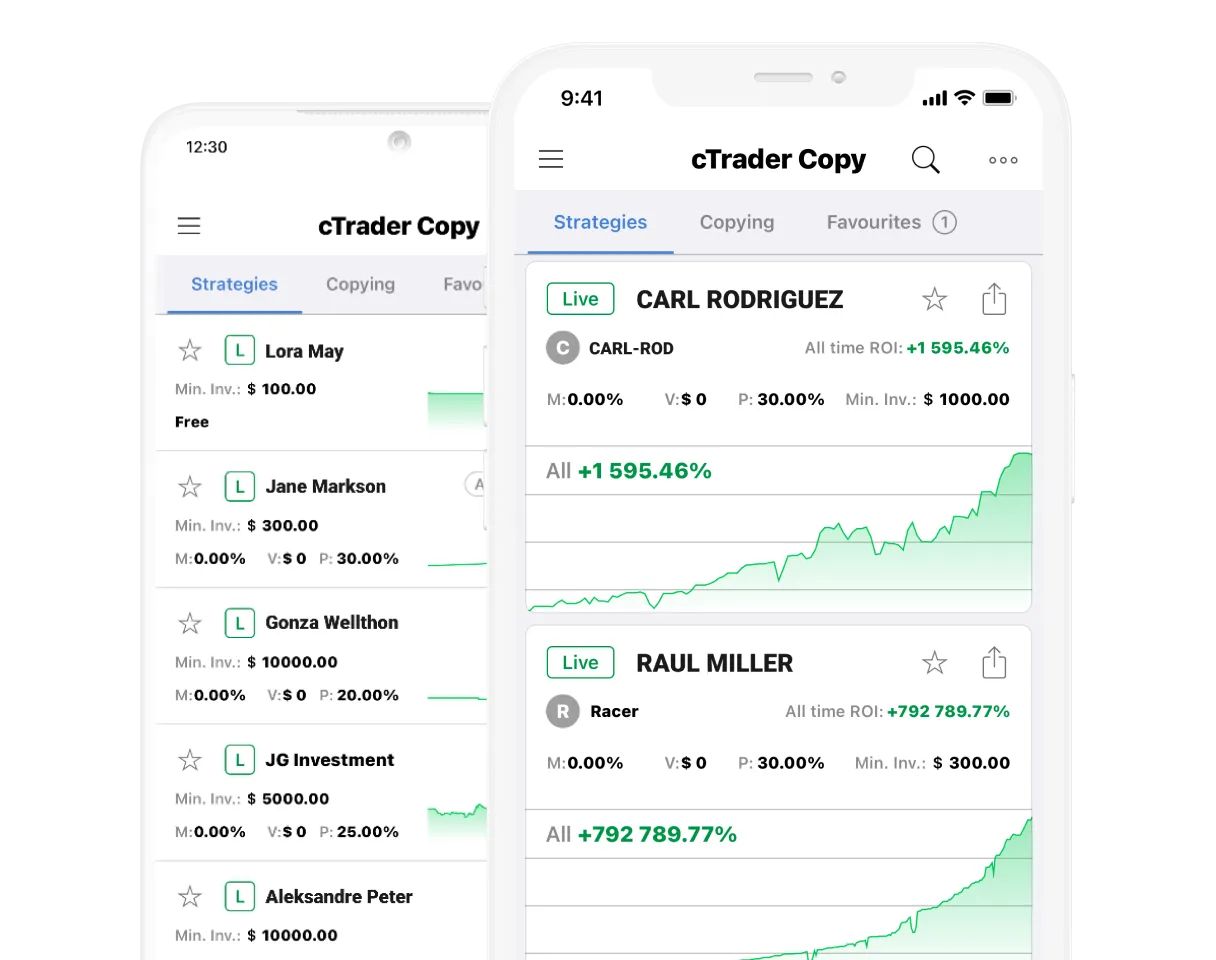

With a single FIXIO account, you can access the cTrader trading anytime, anywhere. By providing you with access to a fast and stable forex trading environment, you will never miss a trading opportunity.

1000 times

FIXIO Accounts

Forex leveraged trading up to 1:1000

A single account provides anytime and anywhere access to the trading environment, with a choice of up to 1:1000 forex leverage. Professional Forex traders can consistently profit from market fluctuations by managing risk and overall exposure.

3 Types

Choose from ECN / STP / PREMIRER Accounts

Trading Accounts - No Dealing Desk

FIXIO provides transparent access to the global forex market. In an environment free of dealing desk intervention, forex traders can realize profits no matter how large their trades are.

FAQ:

-

History of Forex Trading

In the past, exchange transactions were strictly restricted by law in Japan, and the Foreign Exchange and Foreign Trade Control Law, which came into effect in 1949 after the war, prohibited currency transactions in principle. Later, in 1980, the law was amended to liberalize foreign transactions, allowing foreign exchange transactions related to trade and other activities. Only banks and other financial institutions were allowed to engage in such transactions. Individuals were not allowed to engage in foreign exchange transactions. And foreign currency investments were generally "foreign currency deposits" or "foreign currency MMFs" offered by various banks.

This situation, however, changed dramatically with the enforcement of the "Revised Foreign Exchange Law" (1998), introduced earlier. Foreign transactions have been completely liberalized, and the Tamegin principle (foreign exchange authorized banks = only Tamegin can conduct foreign exchange transactions) has been abolished.Restrictions on foreign exchange transactions were put in place to stabilize the currency and protect domestic industry. The reason for the restrictions on foreign exchange transactions was to ensure currency stability and protect domestic industry. The risk of a large inflow or outflow of currency in an unstable domestic economy could be a hindrance to growth. However, as Japan's economy globalized and its society matured, its main industries shifted from manufacturing to services and finance, and it was pointed out that the financial industry was lagging, and the Tokyo market was losing its position. In response, the Foreign Exchange Law was amended to lift the ban on full-fledged trading, and FX, which had been traded in the U.S., Europe, and some Asian countries, was promptly introduced in conjunction with this liberalization.

Foreign Exchange Trading Market

The foreign exchange market (sometimes simply referred to as the "exchange market") is a place where different currencies, such as the yen and the dollar, are exchanged (bought and sold). There are various events in the world that require the exchange of different currencies. For example, there are cases where people exchange yen into foreign currencies at banks when traveling abroad, import companies procure foreign currencies in exchange for yen to settle payments with foreign countries, and domestic investors exchange yen for foreign currencies when buying and selling financial assets denominated in foreign currencies. In order to meet these various needs, the foreign exchange market is where currencies of many countries are exchanged (bought and sold).

However, the term "market" does not refer to a specific place or building, such as a fish or vegetable market, but rather an abstract concept that indicates the overall transactions that take place within a specific framework, and many transactions are conducted via telephone or electronic devices. Transactions in the foreign exchange market can be divided into two main categories: (1) transactions conducted by individuals or companies with financial institutions (referred to as "transactions with customers" from the perspective of financial institutions) and (2) transactions conducted directly between financial institutions or through foreign exchange brokers (referred to as "interbank transactions" in the foreign exchange market) Online trading is the most common type of foreign exchange trading.

Online Currency Trading

Among the major participants in the foreign exchange trading market, the fastest growing segment is retail foreign exchange traders (individuals) who participate in online foreign exchange trading primarily for speculative reasons, with the ultimate goal of profiting from currency fluctuations (market fluctuations) or hedging against unnecessary foreign exchange risk.

One of the fastest-growing segments of major participants in the foreign exchange trading market is the retail forex individual trader. This segment participates in the forex market through brokerage firms or banks. In this case, the bank or broker issues a small customer with a trading account where deposits and withdrawals are made in local currency (usually the local currency of the customer's location), and the customer can trade currency online or by phone.

Forex Trading through a Broker

Participating in the Forex trading market through a broker like FIXIO means that you have access to real-time prices in the Forex market and are offered buy and sell prices for many instruments through an online trading platform (or via telephone). You are free to decide which price you want to buy or sell at and vice versa and you can execute your trades whenever you want.

-

What is Forex Trading?

Foreign exchange trading, also called "currency trading," is the exchange of two currencies based on the exchange rates of different countries. This always involves the simultaneous exchange (buying and selling) of two currencies and is a transaction in which one of two currencies is bought, and the other is sold. The combination of currencies used in this transaction, such as dollar/yen, euro/yen, or euro/dollar, is called a "currency pair" and the currency displayed on the left side is called the "base currency. As an example of a transaction, in the case of a Euro / Dollar transaction, this means buying Euros and selling Dollars.

While the ultimate objective can vary and is not limited to the below:

- Exchange currency A (e.g., USD) for currency B (e.g., EUR) for travel purposes.

- Exchange currency A (e.g., USD) for currency B (e.g., EUR) for trading purposes.

- Currency A (e.g., USD) is exchanged for currency B (e.g., EUR) for the purpose of profit (speculation).

Not limited to the above, the foreign exchange trading market is today the most liquid and largest financial market in the world, with over $5 trillion traded daily.

-

How are Forex transactions conducted?

Forex trading is, in essence, trading currencies for one another. As such, a FIXIO client sells one currency against another at a current market rate.

To be able to trade, it is required to open an account, hold currency A, and then exchange currency A for currency B either for a long-term or a short-term trade, with the ultimate goal varying accordingly.

Since forex trading is conducted in currency pairs (quotes of value relative to one currency unit against another), the first currency is the so-called base currency, and the second is called the quote currency.

For example, the quotation EUR/USD 1.2345 is the price of the euro expressed in US dollars, which means that 1 euro equals 1.2345 US dollars.

Currency trading can take place 24 hours a day from 22:00 GMT on Sunday to 22:00 GMT on Friday, and currency trading takes place between the major financial centers of London, New York, Tokyo, Zurich, Frankfurt, Paris, Sydney, Singapore, and Hong Kong.

-

What Influences Prices in Forex Trading?

Although there are a myriad of factors that affect the price of foreign exchange transactions (exchange rates) on a day-to-day basis, the main common primary factors are:

Long-term Factors

- Purchasing Power Parity Theory

This theory states that exchange rates are determined by comparing the prices of goods and services in different countries. For example, if the same goods are sold in the U.S. and Japan, and their prices are $1.00 in the U.S. and 120 yen in Japan, then the exchange rate would be $1.00 = 120 yen. - Balance of Payments Theory

This theory considers foreign exchange holdings from trade, investment, etc. to be a factor in exchange rate fluctuations. For example, if Japan's balance of payments is in surplus, it is a factor in the appreciation of the yen.

Short-term Factors

- Interest rate fluctuations and changes in central bank policy rates generally, the currencies of countries with higher interest rates tend to rise, and the currencies of countries with lower interest rates tend to fall.

- Central Bank Intervention

For example, when the Ministry of Finance decides that further appreciation of the yen is not good for Japan, it will have the Bank of Japan sell yen to buy dollars. - Political Factors

Political statements by government officials of various countries regarding trade frictions and other factors may cause significant fluctuations in exchange rates. - Announcement of Economic Indicators

Announcement of actual results that differ from market expectations can be a major currency fluctuation factor. - Regional Conflicts and Wars

When there is concern that a conflict or war will have a significant impact on the economy, it can cause volatility in the exchange rate.

There is not necessarily only one factor that causes fluctuations in the foreign exchange market. There are also cases where the yen appreciates and depreciates at the same time, so a piecemeal view cannot be used to make correct judgments. A comprehensive view is necessary in order to read future exchange rates.

- Purchasing Power Parity Theory

-

What is Forex Trading Software?

Forex trading software is an online trading platform provided to FIXIO clients that allows them to view, analyze, and trade currencies and other asset classes through said software.

In simple terms, clients can be provided with access to a trading platform (i.e., software) that is directly connected to the global market price distribution system and can execute trades without the intervention of third parties.

-

What participants are there in the Forex Trading Market?

The foreign exchange market is classified into (1) the interbank market and (2) the customer-to-customer market.

- Interbank Market

As the name implies, the interbank market is where financial institutions (mainly banks and securities firms) buy and sell foreign exchange through electronic broking systems (EBS) and brokers. For example, if Bank A wants to sell dollars and buy yen, Bank B wants to buy dollars and sell yen. - Customer-to-Customer Market

This is a market where trading companies, manufacturers, funds, individual investors, and other companies that wish to trade in foreign exchange but cannot participate in the interbank market trade with banks by telephone or through the system.

Thus, foreign exchange market participants are primary.

- Financial institutions such as banks and securities companies

- Asset management companies and other institutional investors

- Business companies such as trading companies and manufacturers

- Individual investors, etc.

The daily buying and selling of these global participants cause exchange rates in the foreign exchange market to fluctuate.

- Interbank Market

-

What is Important in Forex Trading?

As a retail Forex trader, the most important factor affecting a trader's trading is execution power and execution speed. Execution power is also referred to as execution rate or execution capacity. The less slippage or refusal of execution from the time an order is submitted to the time it is executed, the higher the executive power.

Execution speed is the number of seconds a trader can hold a position after placing an order.

If your dealing bank or trading broker cannot execute fast enough to get that order price, then a good price is in vain.

-

What are the major Forex currency pairs?

Each currency pair has its characteristics, and certain currency combinations are traded far more than others. The king of currency pairs, consisting of currencies whose movements are monitored and traded around the world, is called a major currency pair.

While traders and news media have somewhat different views on which currency pairs are "major," generally speaking, the following four popular currency pairs can certainly be considered to be included when referring to "major currencies."

- U.S. Dollar/Yen

- Euro/U.S. Dollar

- Pound Sterling/U.S. Dollar

- U.S. Dollar/CHF

Also, most major currency lists include three "commodity currencies" paired with the U.S. dollar:

AUD/USD (AUD/USD), USD/CAD (USD/CAD), NZD/USD (NZD/USD)

Together, these three currency pairs and the aforementioned four currency pairs account for 80% of the world's currency trading.

There are other currency pairs that do not include the U.S. dollar, such as Euro/Yen, Euro/Swiss Franc, and Euro/Pound. These are called "cross currency pairs."

[The four most popular currency pairs]

- EUR/USD Trading

The EUR/USD or Eurodollar is the most traded currency pair in the world.

This is not surprising given that this currency pair is a combination of the currencies of the United States, the world's largest economy, and the European Union, the second largest economy in the world.

This currency pair, which includes the euro and has been in full circulation since 2002, also has the distinction of being the newest of the major currency pairs.- Dollar/Yen Trading

The first thing many traders notice about trading the dollar-yen is that the value of one pip is considerably larger than for other major currency pairs. This is due to the relatively low value of the yen relative to the U.S. dollar.

In the carry trade, in which traders borrow the currency of a country with low-interest rates and invest in the currency of a country with high-interest rates, half of the trades are made using the yen. The Bank of Japan has been fighting against low inflation and low growth for many years, and as a result, a history of zero interest rate policy and negative interest rate policies exists in the background.

The yen is also widely regarded as a haven, as evidenced by its strength even in uncertain economic times. Traders have a similar view of the U.S. dollar, which complicates the dollar-yen dynamic.- Pound Sterling/U.S. Dollar Trading

The nickname "cable" comes from the history of sending quotas through undersea cables across the Atlantic Ocean. Before losing its position to the U.S. dollar, the British pound was the world's reserve currency.

Pound Sterling and Euro-dollar EUR/USD have much in common. First, although the United Kingdom has not adopted the euro, its economic strength is still based on its strong ties to the European Union. Second, unlike the dollar-Swiss franc and the dollar-yen, the U.S. dollar is a quoted currency in both the Pound Sterling and Euro-dollar currency pairs. This means that the Pound Sterling and Euro-dollar tend to rise when the U.S. dollar weakens and fall when it strengthens.

Like all other currency pairs and national central banks, the Bank of England and the U.S. Fed, which monitor the behavior of the two currencies that make up the pound dollar, have significant influence over these currencies.- Dollar/Swiss Franc Trading

Some may find it strange that the Swiss franc, the currency of Switzerland, which is not part of a global economy like the US, Japan, or the EU, is among the top four major currencies.

The reason is that, like the Japanese yen, the Swiss franc is perceived as a Safe Haven. Traders use the Swiss franc as an effective low-risk investment during unstable economic conditions or sudden market fluctuations. Switzerland's long-standing confidence in its stability, safety, and neutrality is a contributing factor to this position.

Typically, the Swiss franc will move in sync with the euro during times of low market volatility. This is due to Switzerland's close ties to the euro economy.[Commodity Currencies]

- AUD/USD Trading

As currencies of natural resource-producing countries, the Australian, Canadian, and New Zealand dollars are recognized as "commodity currencies" that play an important role in the commodity markets. For example, the AUD/USD is considered to have strong ties to the mining, beef, cotton, and wheat markets.

As a result, price movements in the commodity markets have a significant impact on the AUD/USD exchange rate. The Australian dollar is also subject to policy rate decisions by the Reserve Bank of Australia (RBA), which generally favors higher interest rates than other central banks.- U.S. Dollar/Canadian Dollar Trading

As the second largest country in the world in terms of the national territory, Canada is a natural resource-rich country with abundant forest resources, natural gas, and oil, and its price movements in the commodities market have a significant impact on the price fluctuations of "commodity currencies" such as the U.S. dollar/Canadian dollar.

This currency pair also has a unique characteristic that comes from the Canadian dollar's performance being closely related to the U.S. economy. Because of its relationship with the U.S. economy, the Canadian dollar moves similarly to the U.S. dollar in minor currency pairs such as the Euro/Canadian dollar. However, when it comes to the U.S. dollar, its movements are very unpredictable.- New Zealand Dollar/USD Trading

The New Zealand dollar, also known as the "kiwi," is one of the major commodity currencies when combined with the U.S. dollar. Along with international trade and tourism, agriculture is a pillar of the New Zealand economy, and therefore the New Zealand dollar/USD is influenced by the price movements of agricultural commodity stocks.

However, as with all currency pairs, the influence of the central bank should not be underestimated. For this currency pair, one should be wary of the policy rates determined by the Reserve Bank of New Zealand, especially if it has a different policy than the U.S. Fed. -

What are the minor Forex currency pairs?

Small currency pairs or cross currency pairs are both currency pairs that do not contain USD and are classified as minor currencies. In particular, "cross currency pairs" are currency pairs that do not include USD, such as EUR/JPY, EUR/Swiss Franc, and EUR/Pound.

[Cross Currency]

- Euro/Pound Sterling Trading

Euro/Pound is an important currency pair that supports economic activity in the UK and EU economies. Especially since the Brexit decision on June 23, 2016, keep an eye on the Euro/Pound.

- Euro/Yen Trading

The euro, the world's second largest currency in circulation, can play the role of the U.S. dollar in currency pairs. One example is the Euro/Yen. Since both the U.S. dollar and the yen are considered Safe Havens, their influence can be eliminated by combining them with the euro instead of the U.S. dollar.

- Euro/Swiss Franc Trading

Similar to the Euro/pound and Canadian dollar/U.S. dollar relationships, the Euro/Swiss franc is more closely tied to each other due to the economic relationship between the two countries; for four years starting in 2011, the value of the Swiss franc was pegged to the euro by the Swiss National Bank.

-

What is Exotic Currency?

Exotic currencies do not fall into the minor currencies listed above in foreign exchange trading, such as foreign exchange margin trading (FX). These are currencies such as the Polish zloty, Hungarian forint, Turkish lira, Mexican peso, and other Eastern European countries and emerging markets, rather than major currencies such as the US dollar, euro, Japanese yen, British pound, and Swiss franc.

In general, some exotic currencies offer very high-interest rates and "high swap points," but on the other hand, they are also characterized by low liquidity, limited information, and difficulty in applying technical analysis.

- Instruments

Get started now

Opening an account is as easy as 3 steps! Start investing in FX with FIXIO!

Sign up

Create an account in minutes & upload your documents.

Fund your account

Make instant deposits to your FIXIO Wallet via debit card, wire transfer or your preferred online payment method.

Trade

Download your favorite trading platform on your device of choice & begin trading.

Our websites use cookies to offer you a better browsing experience by enabling, optimising, and analysing site operations, as well as to provide personalised ad content and allow you to connect to social media. By choosing 'Accept all' you consent to the use of cookies and the related processing of personal data. Please view our privacy policy.

-

Necessary Cookies

Essential for website functionality, allowing navigation and login access.

-

Functional Cookies

Enhance user experience by remembering preferences and settings.

-

Analytics Cookies

Collect data on user interactions to improve site performance and content.

-

Performance Cookies

Monitor and optimize website performance for a smoother user experience.