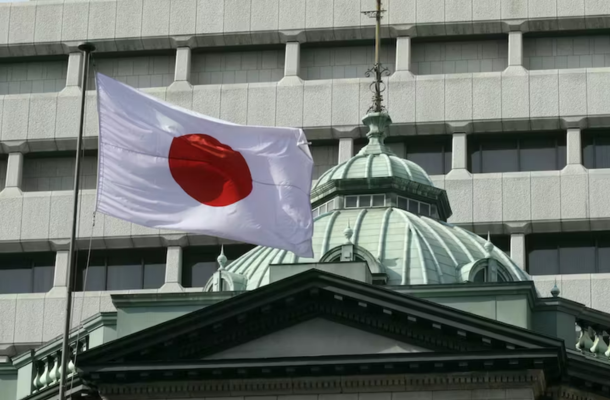

This morning, the Bank of Japan kept its monetary policy very loose, with no adjustments made to the Yield Curve Control policy or interest rates.

The Bank of Japan chose to keep the interest rates steady at -0.10% despite recent discussions about moving away from negative rates. Governor Ueda emphasized the need for wage growth and consumption to drive demand-driven inflationary pressures before considering a shift in rates.

The market's attention shifted to the Monetary Policy Statement following the decision to hold interest rates at -0.10%. The key points from the statement included a unanimous vote to maintain the short-term policy interest rate at -0.10%, endorsing a +/- 0.5 percentage point range for 10-year JGB yields, and committing to more flexible implementation of the Yield Curve Control (YCC) policy.

Concerning the macroeconomic conditions, Japan's economy exhibited moderate recovery, supporting employment and wage growth. Despite elevated price levels, private consumption increased at a moderate pace. Inflation expectations displayed upward movements, and the economy is expected to continue recovering moderately in the near term. However, the Board anticipates a deceleration in the annual inflation rate in the near term.

Before the Bank of Japan's monetary policy decision, the USD/JPY pair fluctuated between a low of 147.496 and a high of 147.794. However, in response to the interest rate decision and Monetary Policy Statement, the USD/JPY dropped to a low of 147.955 before climbing to a high of 148.105, with the pair up by 0.34% at the time of writing.

Investor interest in the Bank of Japan press conference is expected to be heightened. Comments regarding a potential move away from negative rates and the conditions under which the Board would vote for such a shift will influence the USD/JPY pair. The sensitivity of USD/JPY to the press conference will depend on references to a shift away from negative interest rates.

In the US session, focus will shift to Fed monetary policy, particularly after better-than-expected US jobless claims. The preliminary US service sector PMI for September is also expected to attract attention, with economists projecting an increase from 50.5 to 50.6. A pickup in service sector activity may reinforce expectations for a November Fed rate hike, although higher rates could impact labor market stability and wage growth, potentially easing consumption and demand-driven inflationary pressures.

Subscribe to our daily newsletter and get the best forex trading information and markets status updates

Trade within minutes!

Comment (0)