The BLS adjusts December CPI to 0.2% and November to 0.2%, indicating ongoing inflation; December's core CPI remains constant at 0.3%.

The Bureau of Labor Statistics (BLS) has adjusted consumer inflation figures from January 2019 to December 2023, a regular process to refine seasonal factors affecting inflation analysis.

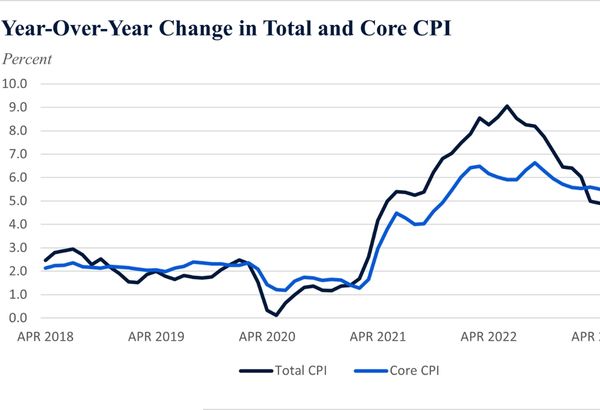

December's consumer price index (CPI) increased by 0.2%, revised down from the initial 0.3%, while November's CPI was revised upwards to show a 0.2% rise instead of the previously reported 0.1%. These adjustments provide a clearer picture of recent inflation trends.

Excluding volatile food and energy sectors, core CPI remained unchanged, rising by 0.3% in December. Annually, December's core CPI surged by 3.9%, notably higher than the core Personal Consumption Expenditures (PCE) price index, the preferred inflation measure of the Federal Reserve.

These CPI revisions hold significance for Federal Reserve officials as they assess their strategies against inflation. The mixed signals from monthly CPI data, coupled with sustained core CPI increases, influence their monetary policy decisions.

Financial markets anticipate potential Federal Reserve rate cuts in the coming months. Since March 2022, the Fed has raised its policy rate by 525 basis points, reaching a range of 5.25% to 5.50%. The revised December CPI data could impact the Fed's approach to rate adjustments.

The CPI revision has altered the outlook on inflation trends and shifted expectations for the Federal Reserve in several ways:

- Modified Perception of Inflation Severity

- Indication of Persistent Inflation

- Implications for Federal Reserve Policy

- Market Expectations Adjustment

- Core CPI Consistency

In summary, the revised CPI data presents a nuanced scenario, indicating that inflation trends are not consistently diminishing and warrant a thoughtful response from the Federal Reserve to stabilize prices without hindering economic growth.

Subscribe to our daily newsletter and get the best forex trading information and markets status updates

Trade within minutes!

Comment (0)