Scope Ratings predicts that CEE-11 growth will improve from a projected 0.7% in 2023 to 2.5% in the current year and 3% in 2025. The growth will be fueled by reduced inflation and increased real wages.

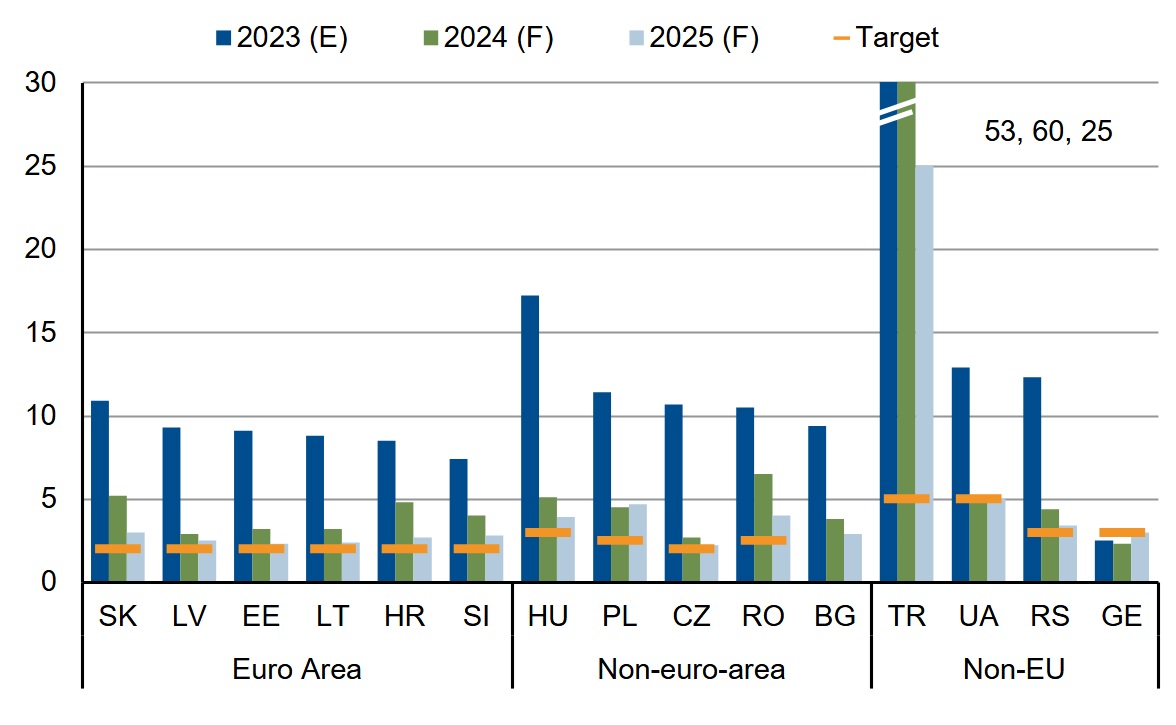

We predict a decrease in headline inflation for Central and Eastern European EU members (CEE-11)*, from an estimated 11.2% last year to 4.6% in 2024 (Figure 1). Although there is strong nominal wage growth, and a possible wage spiral indicates potential risks. The external deficits are expected to stay relatively unchanged, due to a gradual reversal of the regional terms-of-trade shock. This will limit import growth as domestic demand decreases, despite having adequate natural gas reserves. Export performance remains weak due to subdued external demand.

Figure 1. Headline inflation, annual average, %

Source: National central banks, Eurostat, IMF, Scope Ratings forecasts

The fiscal challenges persist as governments in the area grapple with the dual goal of reducing budget deficits post-Covid and providing aid to vital sectors, while also increasing spending on energy, infrastructure, and defense. Financing ongoing budget deficits is made more difficult by the increased interest payments in 2024, particularly for countries with substantial borrowing needs and shorter debt durations. Governance risks also persist, with the flow of EU funds being crucial for the region's economic performance. Significant EU transfers to Poland and Hungary are impeded due to rule of law issues, hampering economic recovery. Moreover, higher policy rates in CEE countries compared to the euro area have complicated market-based financing.

The risks to the credit ratings of CEE sovereign issuers are generally evenly balanced in 2024, following a series of downgrades and outlook adjustments in 2023. The downgrades in 2023 were driven by structural economic risks and the lasting effects of energy and inflation shocks, which impacted real growth, public finances, and economic resilience.

Scope Ratings downgraded Hungary to BBB, Czech Republic to AA-, and Poland to A last year. It also maintained a Negative Outlook for Slovakia, which is rated A+. The agency revised down the outlooks for Estonia (AA-/Negative), Latvia (A-/Stable), and Lithuania (A/Stable), reflecting economic challenges and increasing geopolitical tensions due to Russia's actions in Ukraine. Beyond the EU, Scope has a Negative Outlook on Ukraine's foreign-debt ratings (CC), and in January 2024, it changed the Negative Outlook on Turkey's B- foreign-currency ratings to Stable, attributing this shift to a move towards more conventional monetary policy supporting a gradual rebalancing of the economy.

Subscribe to our daily newsletter and get the best forex trading information and markets status updates

Trade within minutes!

Comment (0)