The sentiment index weighted by Bitcoin offers insights into prevailing expectations among cryptocurrency investors following Wednesday's market decline.

After a panic selloff on Wednesday, January 3, led by a speculative research note hinting at potential SEC rejection of ongoing ETF applications, the market sentiment index now offers insight into the prevailing expectations among crypto investors following the sell-off. Are market participants anticipating a SEC rejection of Bitcoin ETFs in January 2024, or are these rumors largely unsupported?

The significant drop in Bitcoin (BTC) on Wednesday is linked to a pessimistic research note released by Matrixport, a Digital Asset management firm. The speculative note hinted at the possibility of the SEC rejecting ongoing ETF applications.

As the SEC's decision is expected by Jan 10, the rumor spurred panic among BTC holders, resulting in the liquidation of over $165 million worth of BTC LONG positions and a 10% reduction in market capitalization, all occurring within a mere 12 trading hours on Jan 3.

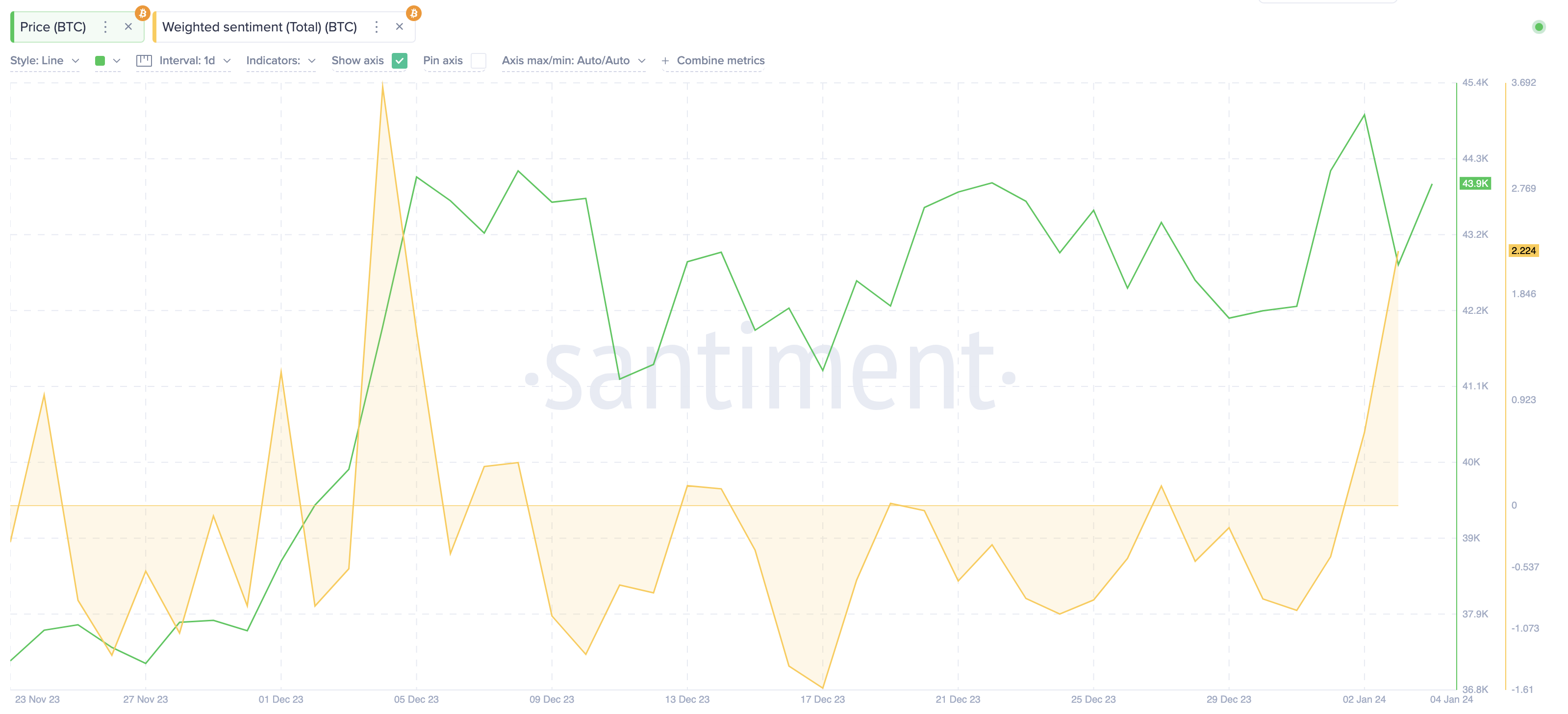

Despite the rumors, an essential on-chain metric indicates that the majority of investors have swiftly dismissed the concerns. Santiment's weighted sentiment chart, which gauges the frequency of negative mentions against positives, reveals reassuring data. The latest reading demonstrates a notable increase in BTC's weighted sentiment score, shifting from a negative value of -0.91 on Dec 31 to a positive value of 2.22 as of Jan 4, following news of the impending SEC verdict.

Bitcoin (BTC) Weighted-Sentiment vs. Price

When the number of positive remarks surpasses the negative ones, the Weighted Sentiment index rises into positive territory, and conversely, it declines. With BTC's weighted sentiment index trending at 2.22, it signifies that positive comments about Bitcoin have outweighed the negatives in the past 24 hours. This suggests that amid the dominant discussions about the Spot Bitcoin ETF verdict, most market participants believe that a rejection is improbable.

Further confirming this prevailing positive sentiment, the price of Bitcoin (BTC) has surged by 7% from its low of $40,750 yesterday, reclaiming the $44,000 milestone. As of the current time, BTC is trading as high as $44,320 during the Eastern Time morning hours.

Subscribe to our daily newsletter and get the best forex trading information and markets status updates

Trade within minutes!

Comment (0)